30+ Front end debt to income ratio

Maximum debt-to-income ratios for AUS approval on FHA Loans. Today the debt ratio requirements for an FHA.

Athene Holding Ltd Merger Prospectus Communication 425

The front-end DTI ratio shows the percentage of income that goes toward your mortgage or housing-related expenses.

. The front-end ratio would be 030 slightly higher than an acceptable front-end ratio. On the off chance that a homeowner. Find the DTI ratio for your rent or mortgage loans and credit cards.

Calculate your debt-to-income ratio using our simple calculator. You turn the fractional part into a percentage which results in 226. A typical monthly mortgage includes the principal interest taxes and insurance and HOA dues.

You divide 2375 by 10500 which sets out to be 0226. It is calculated using your projected monthly mortgage payment. To calculate your debt-to-income ratio add up all of your monthly debts rent or mortgage payments student loans personal loans auto loans credit card payments child support.

To determine your DTI ratio simply take your total debt figure and divide it by your income. Lenders generally look for the ideal front-end ratio to be no more than 28 percent and the back-end ratio including all monthly debts to be no higher than 36 percent. By using this method you can calculate your debt-to.

However these guidelines allow for higher ratios of up to 569 with. For manually underwritten loans Fannie Maes maximum total DTI ratio is 36 of the borrowers stable monthly income. In order to get an approvedeligible from DU Findings on loan programs are the following.

Expressed as a percentage a debt-to-income ratio is calculated by dividing total recurring monthly debt by monthly gross income. You can calculate front-end DTI ratio by taking your total monthly housing expenses and dividing it by your gross monthly income. The front-end debt-to-income DTI ratio is a variety of the DTI that computes the amount of an individuals gross income is going toward housing costs.

Debt to Income Ratio 5500 2440 443 The DTI guidelines for FHA mortgages allow for a maximum of 43. The debt-to-income ratio is a tool used by lenders to determine if you can afford the house or not. The maximum can be exceeded up to 45 if the.

This debt-to-income ratio calculator is designed to help you understand what you need to do in order to qualify and close on a mortgage loan. Lenders prefer to see a debt-to-income ratio. If your projected mortgage payment for all of this was 2000 and your monthly.

To get the percentage multiply the quotient by 100. This number will be compared against your income to calculate your back end ratio. Instead assume that the income is 12000 monthly resulting in a front-end ratio of 025.

Lenders prefer a back-end DTI ratio lower than 36 and no more than 28 for. Front-End Ratio Monthly Housing Debt Gross Monthly Income Back-End Ratio All Monthly Debt Gross Monthly Income Check out our Online Debt Snowball Calculator which helps you.

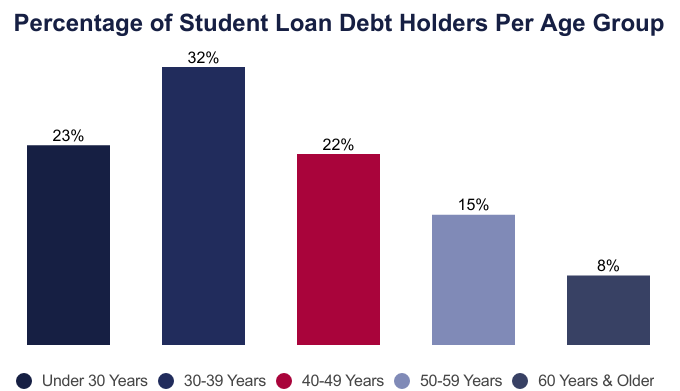

Average Student Loan Debt By Age 2022 Facts Statistics

What Is The Maximum Housing Ratio For A Conventional Mortgage What Is The Max Total Debt To Income Ratio Quora

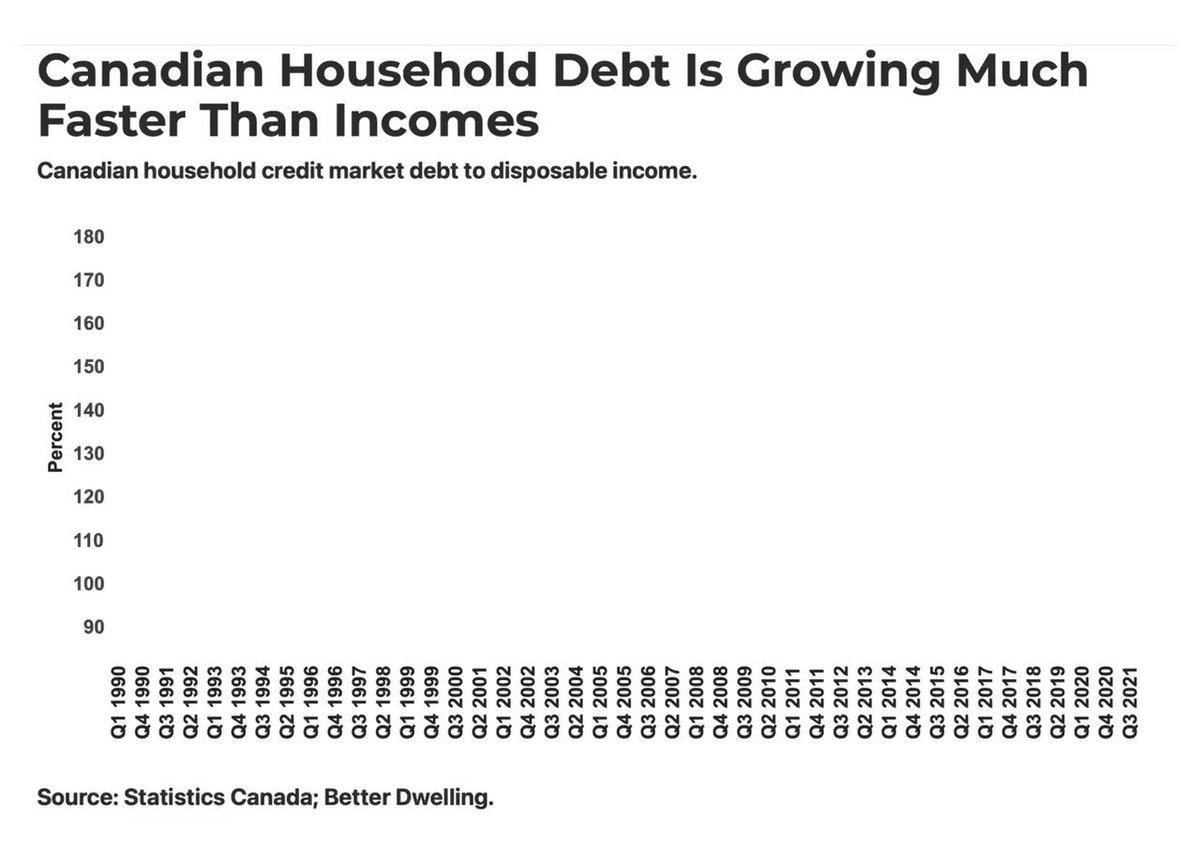

Canadian Household Debt To Income Ties Record Bigger Economic Drag This Time Better Dwelling

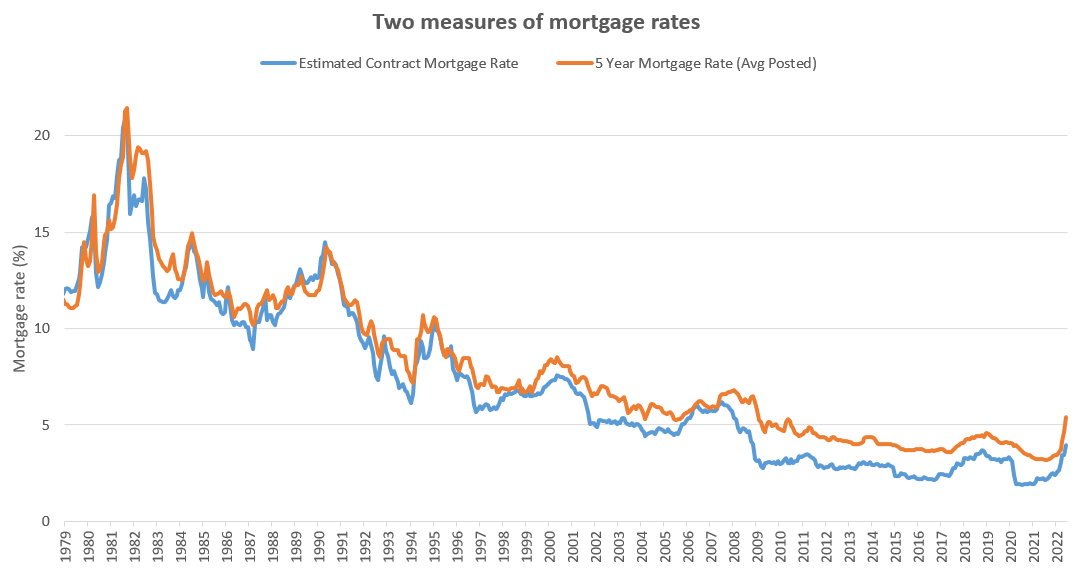

High Frequency Un Affordability House Hunt Victoria

U S Mortgage Delinquency Rate 2000 2022 Statista

What Is The Maximum Housing Ratio For A Conventional Mortgage What Is The Max Total Debt To Income Ratio Quora

Back End Debt To Income Ratio Debt To Income Ratio Debt Ratio Debt

What Should Your Total Debt To Income Ratio Be Quora

Canadian Household Debt To Income Ties Record Bigger Economic Drag This Time Better Dwelling

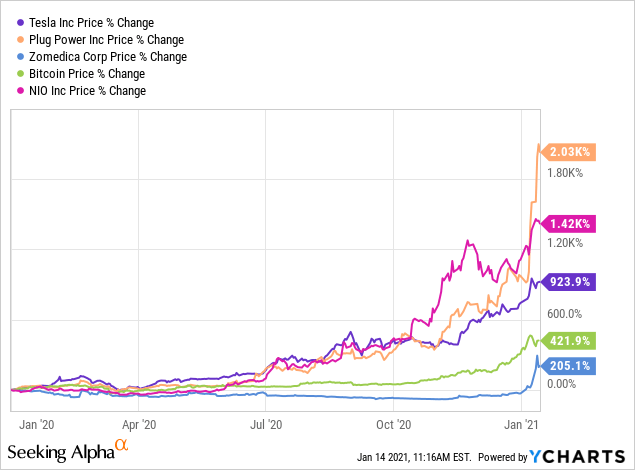

A Historic Margin Call Could Bring The Next Stock Market Crash Despite Low Interest Rates Seeking Alpha

What Is The Maximum Housing Ratio For A Conventional Mortgage What Is The Max Total Debt To Income Ratio Quora

What Is The Maximum Housing Ratio For A Conventional Mortgage What Is The Max Total Debt To Income Ratio Quora

Fha Debt To Income Calculator Debt To Income Ratio Real Estate Advice Fha Loans

When Banks Evaluate My Debt To Income Ratio Is Income Accounted For The Gross Revenue I Bring In From Work Or Net Income After All My Living Expenses Quora

:max_bytes(150000):strip_icc()/dotdash_INV_final_An_Introduction_to_Reverse_Convertible_Notes_RCNs_Jan_2021-03-b106070cd20f4cabbd5fc37b0e86518d.jpg)

An Introduction To Reverse Convertible Notes Rcns

Investordaypresentation

What Should Your Total Debt To Income Ratio Be Quora